Latest News

Wirecard: Die Wahrheit wird tot geschwiegen

Wirecard: Die Wahrheit wird tot geschwiegen  350 Investors FINALY SCREWED

350 Investors FINALY SCREWED Olaf Scholz continues to lie - covers up with Billions of Corona Help - People get distructed from the reality!

Olaf Scholz continues to lie - covers up with Billions of Corona Help - People get distructed from the reality! - Secret Services play their games and screw investors

- Secret Services play their games and screw investors - The perfect Money washingmachine for everybody - politics close their eyes

- The perfect Money washingmachine for everybody - politics close their eyes - The Criminal Gang

- The Criminal Gang - Marsalek's Secret List threatens evrybody and he controls even now everything - from Russia with love

- Marsalek's Secret List threatens evrybody and he controls even now everything - from Russia with love  - Die Zeitbombe

- Die Zeitbombe - The Big Loosers - Investors

- The Big Loosers - Investors - Alles und noch vielmehr auf Wirecard News lesen

- Alles und noch vielmehr auf Wirecard News lesen

Topics - Aktuelle Meldungen

Germany's largest media event - Wirecard committee of inquiry

Who knew what at Wirecard? ...

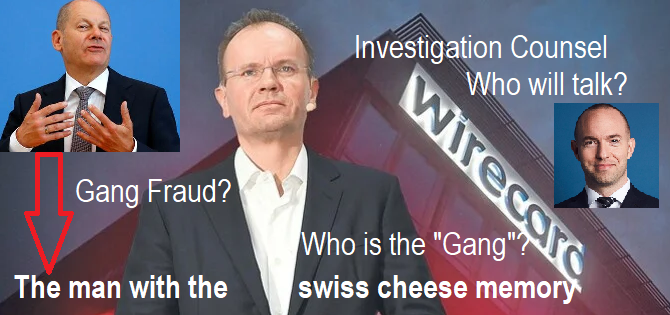

Braun the CEO? Scholz with amnesia?

Marsalek the laughing third?

The Wirecard case is actually a Causa Olaf Scholzread more below ... .... important links ......

The five levels of the Wirecard scandal ,

The government level (BaFin and Finance Minister Olaf Scholz)

The Olaf Scholz case, CumEx is not yet over, Scholz already has a new affair

The BaFin, a bunch of incompetent employees and superiors who have neither experience nor any legal authority, but themselves Well versed in insider trading, has stupid excuses, WireCard is a TEC company and not a financial company, they are not responsible!

The auditor level

Auditors who work with so-called auditors who do not have the least training for such a job

Independent auditing of companies who are also the customers of the business auditors and which the auditors do not want to lose as lucrative customers

The Wirecard board and management (Markus Braun, Jan Marsalek)

Board and management who have an excellent education and years of experience as an investment banker, plus many years for them Deutsche Bank (DWS), have a flawless white vest and have certainly not done anything except to use loopholes and the stupidity of the official supervisory bodies used

The gross investor level * DWS-Deutsche Bank

* DWS - the Deutsche Bank Investment Instrument, now wants to sue Wirecard! For what? Wirecard didn't do anything wrong; on the contrary, Markus Braun had received excellent training at Deutsche Bank for years and learned how to best acquire investors. Markus Braun is certainly not a gang cheater.

The investor level As in any investment portfolio, the small investors are the battered ones. The big ones first stuff their pockets full, for the small investor "sorry" is not left. A shame? Perhaps, but everyone who deals with investing knows the high risks, whoever wants to win big has to be ready to lose big.

The insane idea of lawyers suing the regulatory authorities or even the government for damages can only be seen as money-inducing.The five levels summa sumarum

THE CAUSA OLAF SCHOLZ, a shame for democracy

The media event of the year a spectacle of its own. The coverage of the corona pandemic is getting boring, but it has something to do with the Wirecard investigation committee.

In both events there is a lie that the bars are bending. As always, politics is right in the thick of it, with politicians from all parties involved. What is it actually about?

It's about a lot of money, money which is generously distributed ("pocked" as some ministers said) in order to ... yes, to achieve something? ... to distract from the Facts.

Vaccines are announced, stock prices soar, as there are millions of profits in insider trading.

WireCard, politically sponsored Lienlingskind, announcements let the share price soar, insider traders of a supervisory authority make millions of profits privately

Politicians lose their memory, no problem because the budget is right.

read on, summary of press reports of all colors, left, medium, right.Thursday,19. November 2020- From Isaan News Correspondents around the world - ISAAN-NEWS und ISAAN-LIVE - independent, none political, neutral - reports! Wirecard committee of inquiry - business crime or espionage affair?

A good two billion euros on the Wirecard Group's balance sheet were invented. It is the biggest fraud scandal in post-war history. A committee of inquiry wants the debacle enlighten. Today ex-boss Braun should testify. Will he speak or be silent?The espionage thriller

Wirecard was the shooting star of the German economy, attracted by investors and lobbying for active and ex-politicians , but also dodgy characters . The group Always a touch of Silicon Valley wafted around it: Look here, Germany not only knows cars and machines, but also fintech. It took him nine years from the start Service provider for cashless payments (The Virtual Wirecard-Isaan News experts have been reporting on this for many years and have addressed the gaps in the German digital Stone Age pointed out!) to be included in the illustrious circle of 30 DAX companies.

The rapid ascent was followed by a fall. Obviously as a result of criminal machinations, the investor's dream turned into a nightmare, an air number thanks to air bookings. In June 2020, Wirecard had to publicly admit through tricks and falsifications (by Wirecard employees in Asia! - not by CEO Markus Braun) its balance sheet to have pimped up in unimagined dimensions. 1.9 billion euros in the books was an invention. Auditors have the accounts without complaints for years sanctioned away, supervisory authorities such as the Federal Financial Supervisory Authority (Bafin), slept, if not-as the opposition in the Bundestag suspects-even one Turned a blind eye so as not to endanger the Wirecard hype. Banks (and above all DWS, once again Deutsche Bank!) gladly gave Wirecard loans and high ratings.

The Munich public prosecutor (which already investigated 10 years ago, but suddenly stopped the investigation!) , who in the case again once determined, it is assumed that the now insolvent Moechtegern-Dax group has shown fictitious profits since 2015. Presumably more than three billion euros have been lost gone, which is why investors are complaining. Where the money went is a mystery for now. According to the Munich District Court, 11,500 donors are demanding (The fifth level "the loser") more than twelve billion euros back.

Markus Braun, former CEO of Wirecard, has come straight to the committee from pretrial detention, but he won't have much to say because the committee of inquiry is not a court, just a committee and it will not burden itself sellber.

Amazing (actually not, because everyone was insider trading in the shares of the favorite child Wirecard!) is that financiers, politicians, Bafin and others Regulatory authorities watched or Wirecard courted, although the British investigative journalist Dan McCrum was back in 2015 reported about irregularities. The reporter attests, for example, to the auditing company EY (Ernst & Young) when checking the annual financial statements of Wirecard To have "failed spectacularly" - which the testers of course see differently. It seems like a joke that against the editor of the "Financial Times" because of the Suspected of market manipulation, but Wirecard has not been touched for the time being. The case against the British was dropped in September 2019.

Danyal Bayaz, Finanzexperte der Gruenen im Bundestag, spricht von einem "System kollektiver Unverantwortlichkeit, wo einer auf den anderen zeigt und sagt: "Der hat Verantwortung, I don't. "We have to correct that." But in order to draw the right conclusions, a committee of inquiry should (in which people sit the festivities that are themselves lavish with Wirecard and shares have celebrated victories that don't know anything about TEC or fintech or financial systems!) First find out which institutions failed and where individual ones Guilt favored the scandal. The parliamentary groups from the FDP, the Left and the Greens put it through together, everything just political party and Waeler advertising, nothing comes out of it.

But the clarification will be anything but easy, as should already be shown on Thursday at the first hearing of witnesses. On the one hand because of the abundance of files from the Chancellery, Ministry of Economics and Finance, the supervisory authorities, auditors and probably also tax offices, which have to be viewed first. On the other hand, because of the time pressure. Committees of inquiry have to complete their work within one electoral period because it is not certain whether the MPs involved will also match the newly formed one Belong to parliament.

And thirdly, some important players should have little or no interest in making their knowledge public , as they are being investigated or may be threatened. Already the The very first witness will be a yardstick for this. It is Markus Braun, the former CEO of Wirecard, who has come straight to the committee from pre-trial detention should. It is very likely that he will remain silent, which would be legally correct, since he does not have to incriminate himself. However, the ex-Wirecard manager sees himself as a victim anyway of fraudsters with whom he had nothing to do with, which is probably even the truth.

"We want to try to clear up the scandal as completely as possible," says Bayaz. "It won't be easy. It will be like looking for a needle in a haystack." His FDP colleague Florian Toncar uses a comparison from nature to explain the mammoth task: "We are only now limiting the waters in which we are go fishing. "The opposition politicians agree that" the focus should be on political mistakes. "" We are not a court, "says Fabio De Masi. who sits for the Left Party in the U-Committee.

Why did Merkel still stand up ?

What can you get from Wirecard?Believers demand twelve billion euros "Political mistakes" does not just mean responsibility for the regulatory authorities. Toncar, Bayaz and De Masi want more complexes included: the government lobby for Wirecard as well as the lush intelligence contacts of the former board member of the scandal group, Jan Marsalek, who since June 2020 on the run and is suspected to be near Moscow. Chancellor Angela Merkel had, nine months before Wirecard admitted the wrong balance, used for the company on a trip to China. The opposition asks: How could it be that Merkel advertised the company in autumn 2019?What can you get from Wirecard?

One thing is for sure, the investors get exactly NOTHING back!

Investigation committee in Berlin

Ex-Wirecard boss Braun has to testify There is considerable evidence that business crime is also an espionage affair. Marsalek, who is from Austria, has proven connections to the Russian secret service and was possibly an undercover agent for the Vienna scouts. The Handelsblatt learned from a chat conversation that the person wanted with an international arrest warrant is said to have boasted, "To have several passports, like any good secret agent". The fugitive apparently had close contacts with the right-wing Freedom Party of Austria (FPoe). That in turn took In particular, De Masi on the occasion to reject the AfD MP Kay Gottschalk as committee chairman because he sympathizes with the FPoe and is therefore biased.

However, the opposition could not prevent the election, the AfD was entitled to the post. So far, Gottschalk has expressed himself, who does not belong to the radical wing of his party becomes, in typical opposition fashion. According to his statements, he pursues the same goals as the other opposition groups. His previous statements are evidence of will for technical work.

The committee is particularly explosive for the Social Democrats. She has to worry about the reputation of her candidate for chancellor. Olaf Scholz is political as finance minister responsible for the supervisory authorities that made the Wirecard scandal possible. The SPD sees the responsibility primarily with the auditors. Your chairman Jens Zimmermann emphasizes, however, that this does not mean that the SPD is torpedoing the Enlightenment.

The opposition suspects that the coalition wants to end the committee as early as possible in order to keep the time gap between the federal election in September as long as possible. Bayaz explains: "The Enlightenment culture of the government, especially that of Scholz, has so far left too much to be desired." For this reason alone, the parliamentary investigation is necessary. He hope that the Chancellery and ministries corrected and cooperated in their attitude. "So far However, we should have the impression that files are reluctant and delayed issued. "

COMPLAINTS AGAINST SCANDAL GROUP: DWS raises allegations against Wirecard

The fund company of Deutsche Bank was embarrassed because it invested heavily in the now insolvent payment service provider. At the DWS general meeting, the management under boss Asoka Woehrmann is now shooting in all directions and revealing details.

The board of the fund company DWS had to ask critical questions about the extraordinarily high level of involvement in the scandalous group Wirecard at its general meeting on Wednesday put up with.

Suspicion of insider trading!

Long after several newspaper reports had raised the suspicion of accounting falsification at the now insolvent payment service provider, some had Fund manager of the Deutsche Bank subsidiary bought an unusually large number of shares in the company whereby DWS temporarily became the largest single shareholder. At 600 million euros, DWS CEO Asoka Woehrmann put the damage in the Frankfurter Allgemeine Sonntagszeitung, the entire fund from the sudden one Would have suffered a decline in the price, and which he now wants to sue.

DWS initially filed lawsuits against the former Wirecard managers. At the Annual General Meeting, however, the Chairman of the Supervisory Board, Karl von Rohr, also made it clear that that claims against the auditor EY would also be examined. In order to prevent possible conflicts of interest, the general meeting decided that DWS should initially continue should be checked by KPMG and thus reversed a move to EY that was decided two years ago.

Die Frage eines Aktionaers, ob auch Haftungsansprueche gegen die Finanzaufsicht Bafin oder den deutschen Staat geprueft wuerden, verneinte der fuer die Investmentstrategie zustaendige Board member Stefan Kreuzkamp does not. Instead, he said: "DWS is taking all promising measures to receive compensation for the losses that its fund has made as a result of the (alleged) Wirecard fraud. In this context, we also examine the assertion of claims for damages against other parties involved ".

Talks with Braun shortly after the special report

In addition, Kreuzkamp announced further details as to why DWS was leaving the former CEO of Wirecard, Markus Braun, and the supervisory board chairman Thomas Eichelmann feel deceived. The final demise of Wirecard began with the publication of an audit report by KPMG on April 27, in which many allegations were made Balance sheet fraud could not be eliminated.

"The first meeting between our share portfolio management and Wirecard management took place on April 30, 2020 after the publication of the KPMG special report ", Kreuzkamp reported to the shareholders. In it, CEO Markus Braun expressed his unreserved confidence that the final KPMG report will be positive and EY will confirm this in the annual audit. "This perception came about on May 6th after a telephone call with the chairman of the supervisory board Thomas Eichelmann confirmed.

No personal consequences

Regardless of this, the DWS fund managers had significantly reduced their share holdings on the day of the KPMG report. According to Kreuzkamp, the stock will be around 60 percent by the end of April been reduced. However, it took until June 18 for the weighting of the payment service provider, which was then still listed in the Dax, to be weighted in the index in the DWS funds corresponded - until then, DWS was still overweighted in Wirecard.

Personnel consequences for the fund manager - especially DWS star Tim Albrecht was responsible for the excess weight in Wirecard, both Woehrmann and von Rohr already in interviews with the F.A.Z. decided unnecessarily. There was no mention of that at the Annual General Meeting.

Before the hearing of witnesses. On Thursday the first witnesses will be heard in the committee of inquiry into the Wirecard scandal. The focus is on Markus Braun and Olaf ScholzPress - the spectacle

It will be exciting in the Bundestag's Wirecard investigation committee. Six weeks after the official appointment, the witness interviews begin on Thursday. The focus will be on one, if not the main character in the fraud and bankruptcy scandal surrounding the payment service provider and Dax-Boersenstar: Michael Braun, the CEO of the company based in Aschheim in Bavaria has been invited.

The committee wants to join Braun and other former executives from Wirecard in the investigation, because on the one hand they are the source of the quarrels, who pull themselves into the federal government, but on the other hand some of this group may soon be even less willing to provide information than one might suspect anyway.

It is true that the SPD MP Cansel Kiziltepe goes into the meeting with a research claim: All the evidence we know point to extensive criminals Machinations in management. The former Wirecard executives will have to face these allegations on Thursday.

But Braun and two other Wirecard managers - Oliver Bellenhaus and Stephan Freiherr von Erffa - are in custody. The prosecutor's charge is based on commercial gang fraud, in which higher sales and profits were represented via sham business and so loans could also be swindled. So will Braun & Co. respond to questions? Or invoke their right to refuse to testify? And do they even appear in the round in the Bundestag?

That has remained unclear over the weekend. Because there is an interesting alliance that wants to prevent that: Both the lawyers of the detainees are against Usual presence questioning as well as the public prosecutor's office in Munich, which brought the three managers behind bars.Fear for the safety of the witnesses

The reasons sound similar. On the one hand, an increased risk of corona infection is claimed. On the other hand, there are fears for the safety of the witnesses: You could be attacked, for example by disappointed investors, the public prosecutor warned and pointed out that the fugitive Wirecard manager Jan Marsalek has intelligence contacts.

There is also a risk that the accused managers could use the situation to discuss things directly. And therefore there should only be one video interrogation. Braun's lawyer wants to enforce this by court order.

The lawyer von Bellenhausen has even applied for his client to be discharged because he apparently wants to make use of the right to refuse to provide information and therefore a According to a letter from committee members of the FDP, Left and Greens, it is unsuitable evidence.

Causa Olaf Scholz

In the Bundestag, they don't want to know anything about a video survey or broadcasts and insist on presence. The left-wing MP Fabio De Masi says: I would give Mr. Braun a uch can be demonstrated in pajamas. It is important for the public that the largest financial and accounting scandal in recent German post-war history is public is negotiated.

The Green politician Danyal Bayaz also sees it this way: A survey light by Markus Braun is out of the question for me. He is presumably the main culprit in the Wirecard scandal. There are corona rapid tests in the Bundestag to ensure safety

Will the witnesses testify?

In the letter of the three opposition factions, the argument for a personal appearance of the witnesses reads: The interrogation is more authentic this way and the picture the committee can get of the witnesses is extensive. One does not want to do without the personal impression, says the CDU MP Matthias Hauer.

As for the willingness of the summoned witnesses to provide information, the committee members are under no illusions. But want a complete denial attitude do not accept them. Braun will not be able to refuse to answer all questions, says Bayaz.

In any case, the Bundestag committee is less about the possible acts of Wirecard managers themselves. The goal is different, de Masi puts it this way: giving up The task of the committee is to clarify political responsibility and to deal with the supervisory failure in Germany so that such a case does not happen again.

And that's where the interests of the groups diverge. It is true that all those involved name the fact-finding process in the first place. Florian Toncar from the FDP admits Protocol: We want to find out which control mechanisms did not work for which reasons.

The Federal Financial Supervisory Authority (Bafin) is the focus here. But also the auditors, in the case of Wirecard, the company EY executives from the company are invited to the committee on November 26th.BaFin boss Olaf Scholz

Nobody feels responsible

But of course, with a view to the federal election, it is also about people. The federal government has not exactly covered itself with fame and many wrong decisions hit, says Bayaz. Still, nobody feels really responsible.

The committee of inquiry has to come to terms with this image of collective irresponsibility. Toncar assists: political responsibilities are so far complete underexposed. All of this is aimed primarily at one thing: Vice Chancellor and SPD Chancellor candidate Olaf Scholz. And also on his leadership team in the Treasury.

The Social Democrats are on the counter-offensive and have already identified reasons why Peter Altmaier and Horst Seehofer are also on the committee would have to be loaded. The Minister of Economic Affairs is responsible for overseeing inspectors like EY - should there have been any failures?

And the interior minister may have to be on the committee because of the findings of the security authorities - because of Marsalek's secret service connection. Possibly also as the ex-Prime Minister of Bavaria, to clarify whether there could have been agency failures there.

And in the end the Chancellor will appear. Because during her trip to Beijing a year ago, Angela Merkel advocated Wirecard's business interests in China used, which in turn could be related to the company's suspected fraudulent construct.

The bottom line is very clear. The small level Funef jetties are guaranteed to go empty-handed. The committee of inquiry is just a political farce because it has neither any rights or obligations, nor can he legally do anything.

The opposition uses the election campaign committee. Bafin and Culprit Scholz don't have to say anything, can't even be forced to say the committee has NO legal means at its disposal.

The Wirecard managers will definitely not say anything, because everything they say in public can be used against them.

Wirecard News has a lot of interesting information, stay tuned, there is something new every day

Can a candidate for Chancellor be so "inept" or has he knowingly violated his own orders?

More Isaan News - on BaFin and Olaf Scholz, Jan Marsalek and the "Criminal Club"

Don't forget! the WireCard questionnaire!

Untersuchungsausschuss - Links

SPD Joschka Langenbrinck-sponsors the fraud..

CumEx Scholz und Co, Schluss mit den Luegen

Berlin's Prominenz wird "gegrillt"

The Bafin Zocker - Insider Trading - The Criminal Club continues and the Politics is in between

Jan send - From Russia with Love

Under Investigation

BaFin und der Wirecard Betrug

Olaf Scholz am 17.7.2020 mitten drin

Der Wirecard Club, an unbelievable Story but 100% true

Scholz Knew about the entire WireCard since February2019-but Jan Marsalek was the Darling of the Nation and everybody needed to protect his millions!

Scholz wusste noch viel mehr

Marsalek's Soeldner Armee in Libyen..

Sponsored Links